Are you tired of breaking the bank to get your hands on the latest electronics? Worry no more as we bring you a list of top companies for financing electronics in 2024. From rent-to-own options to flexible payment plans, these companies are making it easier than ever to get the tech you need.

- RTB Shopper

- Flex Shopper

- Approovl

- Abunda

- Buy on Trust

Each of these companies offers unique benefits and financing options, so be sure to check them out and find the one that’s right for you.

Read on to learn more about each company and their financing options.

1. RTB Shopper

RTBShopper is a rent-to-own company that offers a wide variety of products including electronics, furniture, appliances, and more. They are a great option for people who may not have good credit or who simply prefer to spread out the cost of their purchases over time. In fact, they don’t even require a credit check. You can browse their inventory online and add products to your cart, and once approved you can pick up your items the same day from a nearby Best Buy store or have them shipped.

RTBShopper’s Process:

- Shop Their Huge Inventory: Browse thousands of electronics, appliances, furniture, and more online. Add the items you want to the shopping cart.

- Apply for Instant Decision: Get quick approval for your lease-to-own agreement. You’ll need a valid ID (driver’s license, state ID, or passport), Social Security number (or ITIN), and a debit or credit card.

- Get Your Products: Once approved, finalize your lease agreement and confirm the pickup location or arrange for shipment. Enjoy the convenience of same-day pickup at a nearby Best Buy.

Benefits

- No credit required to qualify.

- You can get approved for up to $5000.

- No hidden fees on products.

- You get to choose your payment plan to meet your needs.

- You can get your electronics the same day through pickup at BestBuy stores.

- You can get approved even if you have bad or no credit.

- Easy application process and flexible payment plans.

- Early purchase option available.

Contact

Website: RTBShopper

Email: contact@rtbshopper.com

Phone: 855-785-6501

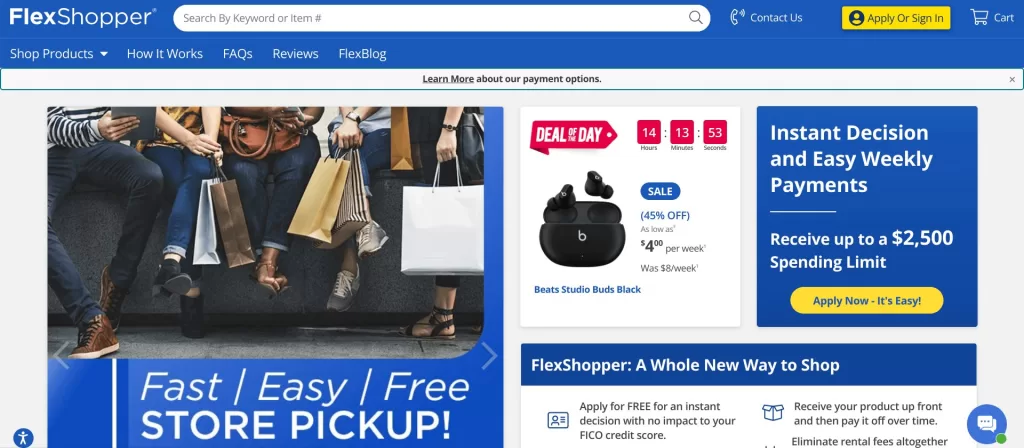

2. Flex Shopper

FlexShopper is a lease-to-own company that allows customers to finance electronics, appliances, and other items. They work with retailers like Best Buy and Amazon, allowing customers to shop from a large marketplace and have their items shipped directly to their door. FlexShopper offers spending limits of up to $2,500, making it a good option for people who may not be able to afford a purchase upfront.

FlexShopper’s Process:

- Shop: Browse FlexShopper’s marketplace featuring over 100,000 products. Find the items you need and choose the flexible payment plan that suits your budget.

- Apply in Minutes: Start by submitting a quick online application. You’ll receive a spending limit decision in seconds, with approvals reaching up to $2,500. This limit can be used for a single item or spread across multiple purchases.

- Sign: Sign the lease agreement and your order will be shipped directly to your doorstep. For some items, you can also choose the option of quick in-store pickup at a nearby Best Buy location.

Benefits

- Bad credit is not an issue

- You can get approved for up to $2500

- You can eliminate rental fees altogether when you pay off your lease within the first 3 months.

- They provide additional benefits such as involuntary unemployment payment waiver, rental protection, 24/7 telemedicine, and courtesy waiver.

- Easy application process

- Early purchase option available

Contact

Website: https://www.flexshopper.com/

3. Approovl

Approovl is a company providing flexible electronics lease-to-own and financing solutions by partnering with financing companies like Acima and retailers like BestBuy. They offer flexible payment terms with no credit check and grant approval for up to $4000. They also offer the benefit of early purchase options at a discounted price.

You can browse their website and add your desired products to cart, and once approved you can have them delivered.

Approovl’s process:

- Shop and Select: Browse and choose the products you want from Approovl.

- Apply for Financing: Once you’ve selected your desired items, proceed to checkout and apply for financing through Approovl’s partner, Acima.

- Review and Sign: When approved, review and sign the lease agreements for your chosen products.

- Enjoy Your Purchase: Following successful approval and agreement signing, you can get the products delivered to you.

Benefits

- No credit check

- 5000+ products to choose from

- Get approved for up to $4000

- Easy application and flexible payment options

- Early payment options available

Contact

Website: Approovl | Electronics Leasing

Email: support@approovl.com

4. Abunda

Abunda is a leading buy now, pay later marketplace offering simple payment plans on millions of products. They have a wide range of products including electronics and appliances. They’ve built a technology that enables you to buy almost any product on Amazon and pay later by partnering with well-known fintech companies like Klarna, Acima, PayTomorrow, Apple Pay, and Affirm to offer flexible payment plans.

Abunda’s Process

- Shop and Add to Cart: Browse Shop Abunda’s extensive selection of products and add the items you desire to your shopping cart.

- Checkout and Apply: At checkout, you’ll be presented with available financing options, select your desired one and you’ll be applied for financing.

- Instant Decision: You can receive an instant decision on your eligibility and finance items for up to $15,000.

Benefits

- Flexible payment plans

- No hidden fees

- Easy application process

- Easy returns

- Get approved for up to $15000

- Early payment option available

- Millions of product options to choose from

Contact

Website: Abunda

Email: support@shopabunda.com

5. Buy on Trust

Buy On Trust is a company that offers financing for electronics. Their program allows customers to acquire desired electronics without the need for a traditional credit card. They have a wide selection of electronics and appliances available for lease. Browse and select your desired items online, then choose a lease agreement that aligns with your budget.

Buy On Trust’s process

- Shop and Choose: You can browse the extensive Best Buy catalog and select the items you want to purchase.

- Get Qualified: The first step involves answering a few quick questions regarding your income and checking account to determine your eligibility.

- Pick-Up: Make a small down payment using a debit or credit card. Choose a convenient Best Buy location for picking up your order.

Benefits

- Get approved for up to $5000.

- No credit needed

- Flexible payment options

- You can pay off anytime after 90 days and save 25% or more on all future payments.

Contact

Website: https://buyontrust.com/

Phone: (888) 274-7732

Conclusion

Financing electronics doesn’t have to be difficult. With the top 5 companies we’ve highlighted in this blog, you can find flexible and affordable financing options to get the tech you need. Whether you’re looking for rent-to-own, lease-to-own, or buy now pay later options, these companies have got you covered.

Remember to always read and understand the terms and conditions, and choose the financing option that best fits your budget and needs. With the right financing, you can stay up-to-date with the latest electronics and take your tech game to the next level.

So, what are you waiting for? Explore these financing options today and get the electronics you need without breaking the bank.

FAQs

What is electronics financing?

Electronics financing refers to the various payment plans and financing options available to consumers to purchase electronics, such as rent-to-own, lease-to-own, and buy now pay later plans.

What are the benefits of electronics financing?

Electronics financing offers flexibility, affordability, and accessibility to consumers who may not have the funds to pay upfront for electronics.

What types of electronics can I finance?

Most electronics retailers offer financing options for a wide range of products, including smartphones, laptops, TVs, gaming consoles, and appliances.

Do I need good credit to qualify for electronics financing?

Not always. Some financing options, like rent-to-own and lease-to-own, may not require a credit check or may accept bad credit.

How long do I have to pay off my financed electronics?

Payment terms vary depending on the financing option and retailer, but typical payment periods range from a few months to several years.

Are there any hidden fees or interest charges?

Some financing options may come with interest charges or fees, so it’s essential to read the terms and conditions carefully before signing up.

Can I return or exchange my financed electronics?

Return and exchange policies vary by retailer, so be sure to check their policies before making a purchase.

What if I miss a payment or default on my financing agreement?

Late fees and penalties may apply, and defaulting on your agreement may negatively impact your credit score.

How do I choose the best financing option for me?

Consider your budget, credit score, and payment preferences when selecting a financing option, and carefully review the terms and conditions before making a decision.

Does Acima get to see our credit score?

Acima may consider your credit score as part of their review of your consumer report. However, they don’t solely rely on your credit score to make approval decisions. Instead, they utilize advanced technology to evaluate your overall financial profile, allowing them to approve many customers with imperfect credit histories.